Insurance Fraud Threats Only Entity Resolution Can Uncover

Insurance fraud is harder to detect and more costly to ignore. From duplicate claims and identity theft to fraud rings and synthetic identities, the schemes are growing more sophisticated. Disconnected systems, poor data quality, and hidden relationships make it difficult for insurers to know who they’re really doing business with. The result? Billions lost annually, slower investigations, and rising regulatory pressure.

The New Face of Insurance Fraud

Today’s bad actors don’t rely on brute force. They exploit blind spots created by data silos, inconsistent records, and outdated verification processes. Even top teams can miss critical warning signs when working with fragmented data and disconnected systems that fail to surface hidden patterns.

Numerous Threats Faced By Insurers Today

Insurers are faced with numerous threats, and the likelihood of each of these threats is amplified by disparate data in disconnected data sources. None of these threats can be effectively addressed without resolving identities, discovering relationships, and improving data quality at scale.

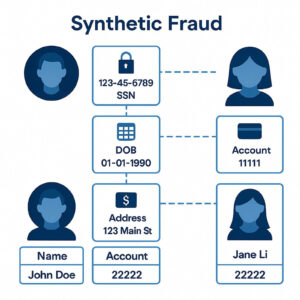

Synthetic Identity Fraud:

Fraudsters use a mix of real and fake information to create synthetic identities that pass standard background checks but aren’t real. United States insurers report synthetic ID fraud as one of the fastest-growing threats, projected to reach $23 billion annually by 2030.

Duplicate Claims / Policyholder Fraud:

Slight variations in names or addresses enable multiple claims for the same incident, or the same policy sold more than once.

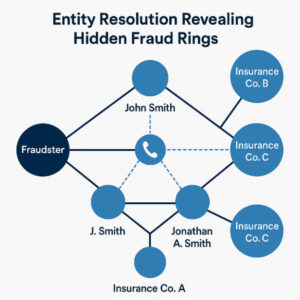

Organized Fraud Rings:

Complex networks of claimants, businesses, and agents operating across regions and products.

Agent and Broker Collusion:

Hard to detect without the ability to map and analyze indirect relationships across policies and claims.

Incorrect Beneficiary Information:

Especially challenging when records span decades or cross business lines.

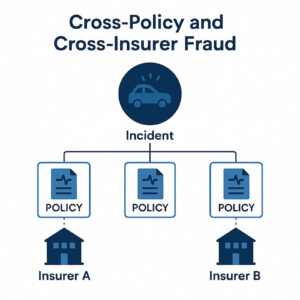

Cross-Policy and Cross-Insurer Fraud:

Identity-masked schemes that span organizations, undetectable without shared context.

How Senzing Helps Uncover the Signals That Matter

The Senzing® SDK makes it easy for developers to employ entity resolution to resolve disparate data across all internal and third-party datasets, accurately match identities, and detect hidden relationships – at scale and in real time. Entity resolution is foundational for data initiatives, and insurers use it to detect fraud, assess risk, and strengthen compliance with:

- Advanced Link Analysis: Uncover hidden connections between individuals, businesses, and claims that may indicate fraud rings.

- Network Analysis: Identify collusion and suspicious patterns across claims and claimants, even without direct connections.

- Real-Time Resolution: Get answers in milliseconds, even with messy, incomplete, or outdated data.

- Explainable Results: Every match is transparent and auditable, supporting both internal review and regulatory compliance.

- Fewer False Positives: Reduces noise in your downstream alerts, helping investigators focus on real threats.

These capabilities support downstream systems that flag fraudulent policies and duplicate claims before processing, without introducing delays. Data from each of the following steps is utilized to identify potential issues:

|

|

|

|---|---|---|

1. Identity Verification | Check government ID, validate SSN, confirm address & contact info. | Ensure the applicant is real and legitimate. |

2. Credit & Financial History | Run credit score checks, assess financial stability. | Determine risk profile and premium rates. |

3. Claims History Check | Review past claims via databases like Verisk Claims Search. | Detect fraud patterns or excessive claims. |

4. Employment & Income Verification* | Confirm job, employer, and income levels. | Match coverage with applicant's financial status. |

5. Medical Evaluation* | Health questionnaires, medical exams, and prescription checks. | Assess life/health risks accurately. |

6. Property/Vehicle Verification | Validate vehicle VIN, ownership and home property records. | Ensure asset value and ownership accuracy. |

7. Fraud Detection & Technology | Use AI, device fingerprinting, geolocation and fraud databases. | Identify suspicious activity and prevent fraud. |

How Verisk Unified 1.6 Billion Records to Strengthen Fraud Detection

Verisk, a global leader in insurance analytics, faced challenges with multiple entity resolution systems across its organization. To standardize data governance and increase efficiency, Verisk implemented Senzing entity resolution as a service across the enterprise. With the cloud-deployed solution, Verisk:

- Integrated over 1.6 billion records

- Resolved 420 million unique identities

- Reduced search times to under a second

- Linked new data sources in days instead of months

- Decreased false positives

According to Gurshish Dang, Head of Enterprise Data Management at Verisk, “Senzing entity resolution delivers better accuracy and fewer false positives than any other option, including other commercial products we looked at.” Implementation was fast and efficient, using only five team members and requiring minimal data preparation. You can learn more about how Gurshish Dang’s team unified data and scaled fraud detection across its business units in the full Verisk case study.

Beyond Fraud Detection: Better Service, Smarter Decisions

While most insurers adopt Senzing to tackle fraud and risk, the benefits often go further. By connecting siloed data, resolving identities and identifying relationships, teams unlock insights that help across the business:

- Beneficiary Identification: Quickly connect policies written decades ago to rightful recipients, avoiding payout delays and abandoned property issues.

- Customer Experience: Flag and fast-track legitimate claims for trusted policyholders, reducing friction and frustration.

- Tailored Outreach: Equip agents and advisors with complete C360 views of each customer or prospect’s relationship to your business.

- Compliance and Governance: Improve data quality, eliminate redundant records, and support enterprise-wide privacy and security initiatives.

In addition to preventing fraud, Senzing entity-resolved data powers more agile, responsive, and trustworthy insurance organizations.

Don’t Let Fraud Hide In Your Data

Fraudsters are evolving fast. Your data systems should evolve faster.

Senzing delivers fast, accurate, and explainable real-time entity resolution, giving insurers the context they need to act with confidence. Whether you’re tackling synthetic identities, uncovering hidden fraud rings, or streamlining compliance, entity resolution enables your team to stay ahead of emerging threats.