Fraud Detection gets taken to a whole new level with Senzing Entity Resolution, using better data matching and relationship awareness to identify risks in real-time.

Fraud Detection with Entity Resolution

Detect and Preempt Bad Actors with Senzing Entity Resolution AI

As the annual costs of fraud escalate into many billions of dollars, organizations face increasingly sophisticated schemes that threaten their operations, finances and brand equity. These schemes include synthetic ID fraud, bust-out fraud, new account fraud and identity theft.

Accurate fraud detection requires robust entity resolution to reveal hidden connections in the data by discovering duplicates and relationships between entities that have been missed by existing systems. Monitoring entities in real time for unusual activity is crucial to detecting fraud. Without proper entity resolution, your downstream monitoring, prevention and investigative systems are severely impaired.

Learn where Senzing fits into your solution or find fraud solutions with Senzing Inside™ from our Partners.

Struggling to Detect Fraud?

Struggling to Detect Fraud?

Senzing offers the first purpose-built AI for real-time entity resolution, which delivers the most comprehensive and accurate entity resolved graph which exposes intentional obfuscation and uncovers non-obvious relationships. This entity-resolved data powers more accurate scoring algorithms and offers investigators more actionable insights, including identifying potential fraud rings and insider trading despite disparate, manipulated or poor-quality data.

Detect More Fraud with Senzing AI for Entity Resolution

Synthetic ID Fraud

Synthetic ID Fraud

Identify and prevent synthetic ID fraud continuously by cross-referencing customer and account attributes.

New Account Fraud

New Account Fraud

Discover the hidden connections of your applicants and customers in real time to prevent new account fraud.

First Party Fraud

First Party Fraud

Detect non-obvious relationships to expose sophisticated networks and enhance your risk-scoring processes.

Identity Theft

Identity Theft

Detect and mitigate identity theft by utilizing entity resolved knowledge graphs to reveal suspicious activity.

Fraud Rings & Insider Trading

Fraud Rings & Insider Trading

Discover fraud rings and insider trading by detecting relationships between trusted parties and subjects of interest.

Bust-Out Fraud

Bust-Out Fraud

Prevent bust-out fraud by identifying suspect entities with synthetic customer details/attributes before they bust out.

With Senzing, we reduce financial crimes for financial institutions’ stakeholders across AML, KYC, fraud and market surveillance.

Crack Down on Synthetic Identity Fraud

Synthetic identity fraud – where criminals combine real and fake personal information to create fictitious identities – has become the fastest-growing type of financial crime in the U.S. Over-reliance on validating core data elements with major credit bureaus has enabled fraudsters to use unissued SSNs, deceased person SSNs, homeless people’s SSNs or children’s SSNs to create synthetic identities.

Senzing principle based entity resolution uses context-aware algorithms to match attributes like addresses, SSNs, phone numbers and email addresses and construct an entity-resolved graph. This advanced approach enables the detection of synthetic identity fraud early, preventing, for example, bust-out fraud before it happens.

Stop New Account Fraud Before It Happens

New account fraud (NAF) is evolving with new digital channels and technologies, becoming more complicated and costly to organizations than any other type of fraud. Organizations face the challenge of effectively verifying the identities of applicants and customers amidst the anonymity offered by digital channels.

Enhanced Identity Verification

Enhanced Identity Verification

By cross-referencing attributes like name, SSN, DOB and address, identity verification is improved.

Advanced Data Integration

Advanced Data Integration

Senzing allows organizations to ingest data from internal and external data sources quickly and easily.

Improved Behavioral Analysis

Improved Behavioral Analysis

With 360-degree views and hidden connections revealed, downstream behavioral analysis improves.

Network Analytics & Risk Scoring Detect First-Party Fraud

To combat first-party fraud, Senzing detects shared relationships between applicants, customers, employees and known “bad guy” data, linking them into networks. Once the entities are linked, you can use your fraud solution to determine the level of risk and create a risk score. Key factors impacting risk scores include:

- Relationships with known fraudsters: New applicants who are connected to accounts that are already in a bank’s fraud or AML data.

- Unusually large and diverse networks: Large, connected networks of accounts and customers may mean a scheme is ready to bust out.

- Statistical anomalies: Networks with abnormal attributes, such as single households sharing dozens of surnames, become easy to detect by scoring systems after Senzing has resolved who is who and shown who is connected to whom.

Compress Customer Data by 15%

By finding high-confidence duplicate customers, Senzing compresses customer data for retail banks – routinely in the 10 to 15 percent range. Senzing also identifies possible duplicates, which is extremely valuable in detecting synthetic ID and new account fraud.

Try Senzing at no cost and analyze your data for duplicates in minutes.

Discover & Preempt Hidden Fraud

Senzing entity resolution helps you discover, detect, and preempt fraud of all kinds. The Senzing engine will show you who’s who, and who’s related to who, despite very messy data. This helps uncover first party fraud, internal fraud, and even insider threat/internal fraud.

Watch Senzing CEO Jeff Jonas Explain How Senzing Helps Organizations Detect & Preempt Fraud

The Senzing AI Helps Detect Many Types of Fraud

- Watchlist screening (e.g., WorldCheck, OFAC, PEP)

- Watchlist whitelisting

- Synthetic identities

- Continuous insider threat/internal fraud

- FATCA (Foreign Account Tax Compliance Act)

- Dormant account harvesting (e.g., address or email change has nexus to previous fraud)

- 1st party fraud (e.g., credit manipulation)

- 3rd party fraud (e.g., account take-over)

- Counterparty visibility

- KYC compliance

- 25% beneficial ownership rule

- Cross-geography loan shopping (e.g., previously denied loans resurfacing in new geos)

Senzing is Smarter Entity Resolution®

Relationship Detection and Awareness

Relationship Detection and Awareness

Combine known relationships and discovered relationships to significantly improve your fraud detection

Entity Centric Learning™

Entity Centric Learning™

Enables the detection of clever bad guys intentionally obfuscating their identities and improves entity resolution of messy data

Entity Resolved Knowledge Graphs

Entity Resolved Knowledge Graphs

Increasingly important in identifying synthetic IDs and fraudulent accounts

Explainability Functions

Explainability Functions

Ensure investigators and oversight groups can confidently understand and explain how entities resolved

True Real Time Entity Resolution

True Real Time Entity Resolution

Consistently outperforms batch-based technology in detecting fraud

Principle Based Entity Resolution

Principle Based Entity Resolution

Delivers better data matching across diverse large, multi-source, culturally-diverse data

Why Senzing is Unique

We’ve been perfecting entity resolution technology for decades, with over $50 million spent building it so you don’t have to. Possibly the biggest innovative difference in our current generation of tech is its principle based approach.

With our principle based entity resolution, the engine can perform world-class entity resolution on new data sets, new entity types and new features – all without retraining, tuning or experts. The significance of this is not fully appreciated until one adds up all of the time and cost other entity resolution technologies require to own and operate. Principle based is just one of many technological advances baked into the Senzing AI.

For geeks wanting a deeper dive, check out what we are doing in the areas of Entity Centric Learning, sequence neutrality and ambiguous conditions. These are so hard to do at scale that, if they are not conceived of when first designing the entity resolution algorithms, one must practically start over to enable them.

Watch Senzing CEO Jeff Jonas explain how Senzing Entity Centric Learning® is essential – a must-have – for finding criminals intentionally trying to hide their identities.

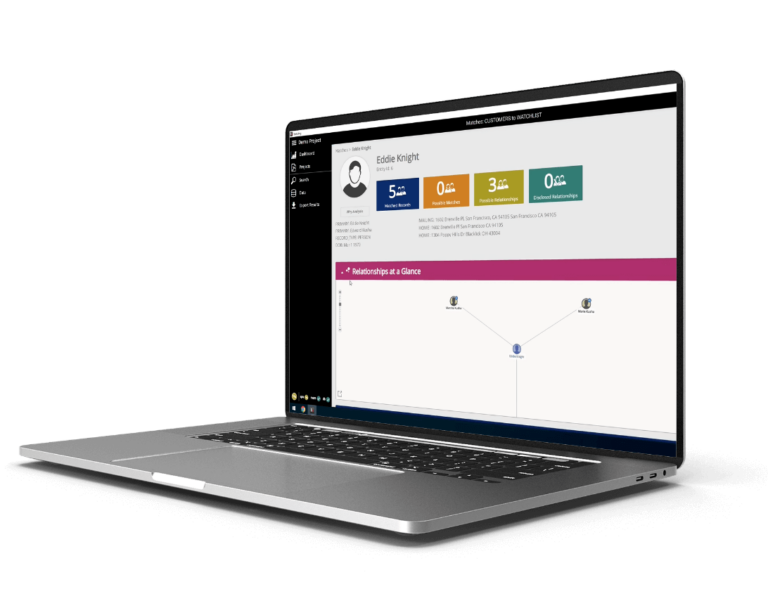

Aptitude Advances Fraud and Financial Crime Detection

Aptitude Global, a technology and data consulting solutions provider, recognized that its data intelligence platform needed better data matching and relationship detection. In response, Aptitude added entity resolution to the company’s platform solutions to combat financial crime and fraud. The Aptitude solution combines the best graph technologies and Senzing entity resolution to fight financial crime, identify politically exposed persons and sanctioned entities, and dynamically calculate customer risk

Senzing entity resolution is a perfect fit for Aptitude. It was the best and only option that met all of our requirements.

– Alan Brown, CTO

How to Get Started

To see the capabilities of Senzing entity resolution with your own eyes, you can use our Desktop Evaluation Tool and see results with your data (or our sample data) in 15 minutes or less. Or schedule a demo with one of our experts. Developers can download and evaluate the software for free with QuickStarts available for Linux or Docker.

If your team is thinking about adding entity resolution capabilities to your solution, or upgrading what you already have, don’t wait to find out what Senzing technology can deliver. Just choose one of our three getting started options and take Senzing for a quick test ride. Get started with Senzing today.

You can license the Senzing SDK directly from Senzing and plug it into your data fabric. Deploy and implement it yourself. If you need support, our expert entity resolution customer support is always free. If you prefer a full solution, you can also work with our partners who integrate Senzing into their specialized solutions that deliver complete 360-degree views of customers and other entities.

The First Real Time AI Purpose-Built for Entity Resolution

Senzing entity resolution is an AI with real time learning that gets smarter through experience. As data accumulates, the algorithms get smarter, detecting non-obvious matches and hidden connections between records. Even when data quality is poor or incomplete, Senzing technology’s Entity Centric Learning™ enables the software to detect connections that would otherwise be missed.

Time-to-Value

Time-to-Value

Gain value quickly with fast installation, setup and deployment, minimal data preparation, and rapid data onboarding with no tuning or training.

Highly Accurate

Highly Accurate

Get the most accurate results from entity centric matching, principle based resolution, built-in domain expertise and real time learning.

Low Total Costs

Low Total Costs

Save on initial deployment costs and ongoing operational costs. Rapidly add new data sources and never have to reload.