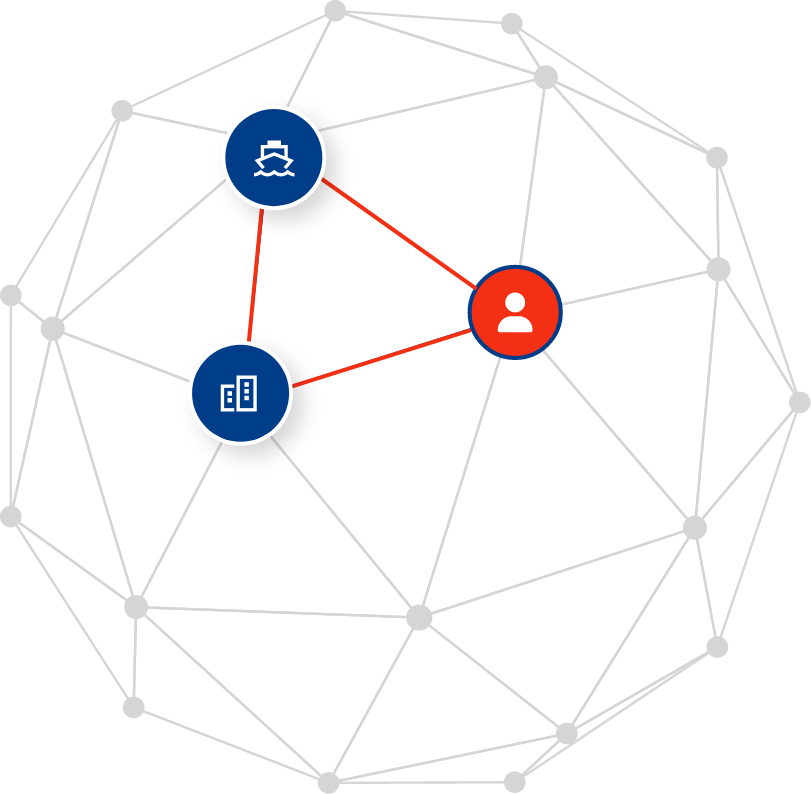

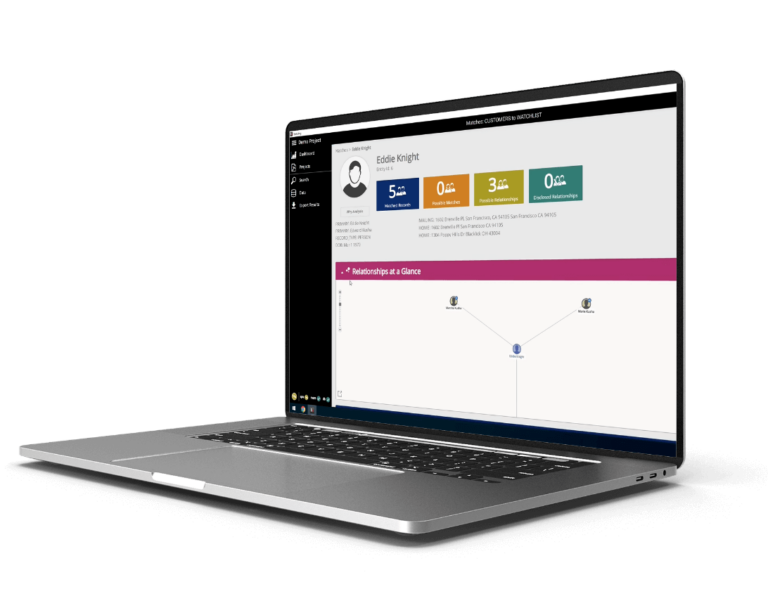

Financial organizations often struggle to comply with Know Your Customer (KYC) compliance requirements. In today’s fragmented data landscape, accurately identifying non-compliant entities without advanced entity resolution and relationship detection can become an impossible challenge.

If you don’t get KYC right, it causes big problems downstream. Entity resolution is crucial for KYC processes because it helps ensure accurate identification and verification of individuals and organizations.