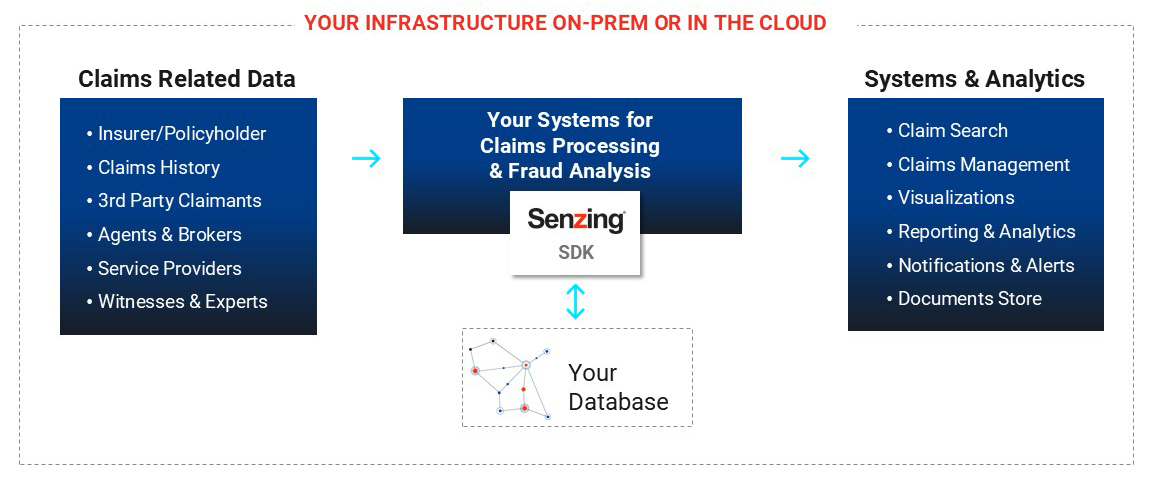

Detecting and preventing insurance risk and fraud is more challenging than ever. Poor data quality, data errors and sophisticated fraud schemes cost U.S. insurers billions annually. Monitoring claims for fraud and adopting new technologies to keep up with clever fraudsters and data risk is a continuous struggle that can impact an insurer’s profits and reputation.

The Senzing® API solves this problem by quickly and accurately resolving entities and discovering relationships and hidden networks. Senzing is a crucial piece of the puzzle to reduce risk, identify fraudsters, prevent losses and improve compliance. Whether you’re a life, health or P&C insurer, the Senzing SDK improves the performance of your risk and fraud systems.

Senzing is also a valuable tool to add to your system when resolving external data sources (such as data from credit bureaus) with internal data to facilitate and improve underwriting.